Turning sustainability pressure into strategic advantage

SustainOpp is an independent partner for organisations that need to show real progress on sustainability.

About Us

SustainOpp exists to close the gap between sustainability ambition and what actually happens in portfolios, operations and reports. The practice brings together deep experience in ESG regulation, sustainable finance, data and transformation, applied inside some of the most demanding sustainability programmes in the market.

Why SustainOpp ?

Because you get institutional-grade rigour without institutional baggage. We bring the depth and discipline you would expect on a major sustainability transformation programme, applied with the focus and responsiveness of a specialist practice. The result is sustainability work that stands up to regulators, investors and auditors – and actually shifts how capital, strategy and operations are run, not just how they are described on paper.

Signal over Noise

Cut through ESG clutter to what is decision-useful.

Value Protection and Uplift

Reduce friction, strengthen resilience , improve decision quality.

Decisions Anchored in Materiality

Prioritise what truly matters - to risk, value creation and long-term resilience.

“They brought order to a process that had grown fragmented over time. What stood out was the balance between rigour and realism - nothing felt academic or disconnected from operations. The outputs were clear, defensible, and usable, which allowed us to progress faster internally and reduce friction with senior management.”

Head of Sustainability – London, UK Industrial Manufacturing“What we appreciated most was the ability to translate complex requirements into something our teams could actually work with. The guidance was practical, calm, and well-structured, without overloading us with theory. We moved from uncertainty to a clear plan quickly, and stakeholder discussions became noticeably easier. The work helped us regain control of both timelines and expectations.”

Chief Financial Officer – Frankfurt, Germany Financial Services“The engagement helped us sharpen focus across the portfolio without creating unnecessary complexity. The team challenged assumptions constructively and gave us options rather than prescriptions. This made decision-making easier at investment committee level and improved consistency across assets, especially where local/regional teams had very different starting points.”

Investment Director – Europe Private Equity“They brought structure to an area that had felt vague and reactive. The outputs helped us prioritise effort and align timelines across projects. It was particularly useful in preparing for discussions with lenders and external advisors, where consistency and clarity matter.”

Development Director – Spain Real Estate & Construction“ESG diligence is often either fluffy or unbearably long. This was neither. They triaged what mattered, translated it into deal-relevant implications, and gave us a usable action list for day one. The output was concise, commercially grounded, and easy to take into IC discussions. It materially improved how we price risk and talk about value creation.”

Director of ESG & Sustainability - UAE Private Equity“They were good at turning complexity into a decision. The approach was structured and direct - priorities, dependencies, and a realistic sequence. The team asked the uncomfortable questions early, which saved time later. We ended up with stronger internal governance and a clearer view of where we need to invest effort to reduce risk (including greenwashing risk) and meet expectations.”

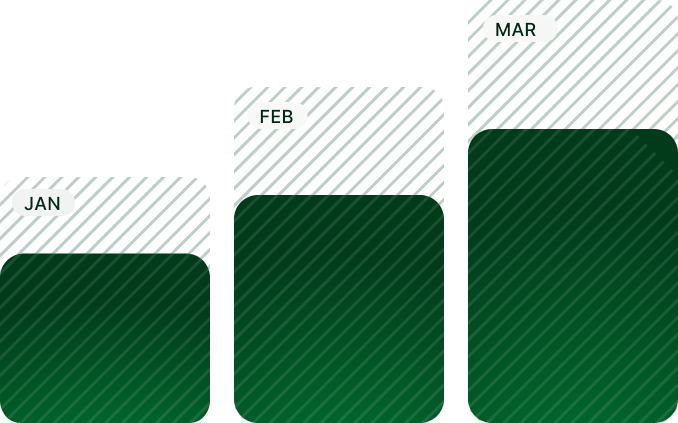

Head of ESG & Climate Risk - Australia Infrastructure & TransportRevenue growth this year

Our Services

Sustainability Reporting & Assurance Readiness

We help you build sustainability reporting that can be defended, not just published. As disclosure regimes harden – CSRD, ISSB, TCFD, emerging climate and nature-focussed rules – organisations need ESG information that is consistent, explainable and ready for assurance.

Sustainability Strategy & Value Creation

We help organisations craft and execute sustainability strategies that drive long-term value creation while meeting stakeholder expectations.

ESG Operating Model & Governance

This is where intent turns into muscle memory. SustainOpp helps organisations build the internal structures, processes and capabilities needed to deliver on sustainability commitments day-to day.

AI-Powered ESG Benchmarking & Diagnostics

When ESG expectations move faster than internal capacity, the obvious question is: “Where do we actually stand – and what should we do next?”

Transactions & Capability Enablement

Deal support and leadership enablement – ESG due diligence, sustainable finance considerations, and focused workshops that enable decision-makers and accelerated delivery.

Where we Deliver

Thought Leadership

SustainOpp treats thought leadership as an extension of the work, not a marketing exercise. We write when we have something decision-useful to say – distilling regulatory change, market signals and lessons from implementation into pieces that help boards, investors and operators work out what this means for us

Regulatory Insights & Guides

Short, plain-English explainers on shifts such as CSRD/ESRS, ISSB, SFDR/Taxonomy, TNFD or UK transition plan rules – anchored in timelines, scope, “must-do vs nice-tohave” and immediate implications for finance, risk and sustainability teams.

Benchmarking Reports

Analyses that draw on our AI-enabled benchmarking and project experience to show where the market really is: how first-wave reports are landing, common disclosure and data gaps, and what leaders are doing differently across various sectors and jurisdictions. These pieces give clients a realistic yardstick.

Strategy & Management Briefs

Briefs on the mechanics of making sustainability stick – governance that actually works, linking ESG to capital allocation and remuneration, building credible transition plans, or avoiding greenwashing traps.

Sector Spotlights

Targeted views on how sustainability plays out in specific contexts – for example financial services, manufacturing, real assets or healthcare – and on cross-cutting themes such as just transition, supply-chain resilience or human capital.

Emerging Topics & Innovations

Early takes on areas that are starting to matter – nature and biodiversity, evolving duediligence regimes, new assurance expectations – and on how tools such as AI and advanced analytics are changing what is possible in ESG data, benchmarking and risk management.

Contact Us

If you’re looking to make progress on sustainability in a structured, practical way, we’re happy to talk.

SustainOpp keeps first contact simple.

- Arrange a 30–45 minute call at a time that suits you.

- If you prefer something more defined, you can request a brief diagnostic.

“We needed an external perspective that could move quickly and speak the language of both risk and execution. The work was structured, well-judged, and grounded in how organisations actually operate. It helped us tighten governance while still keeping momentum, which is a difficult balance to strike.”

Group Risk Lead – New York, USA Financial Services